A Deep Dive into Bitcoin’s Current Market Dynamics

The Unpredictable Rollercoaster

Imagine trying to predict the weather in a storm. That’s what investing in Bitcoin feels like. It’s volatile, it’s unpredictable, and it’s exhilarating. As of June 20, 2025, Bitcoin has been on a wild ride, with prices dipping below key resistance levels. Let’s dive into the recent price movements, technical indicators, and broader market factors influencing Bitcoin’s current trajectory.

Recent Price Movements

The Downward Spiral

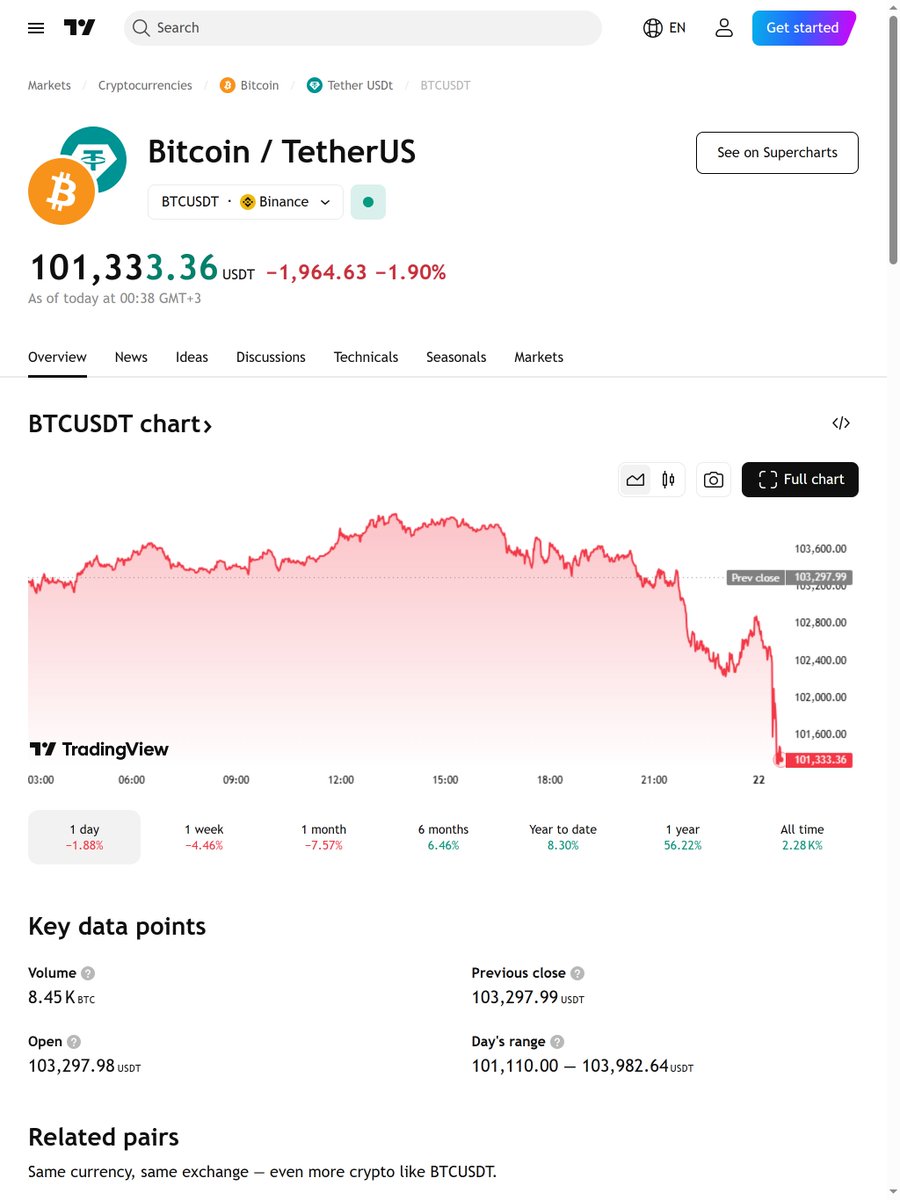

Bitcoin has recently faced a tumultuous period. Prices dipped below the $106.5K resistance level, and bears defended it fiercely, leading to a further decline. Technical analysis indicates that the critical support level at $103.3K is being tested, with potential targets set even lower[1].

The Range-Bound Dance

Over the past week, Bitcoin’s price has fluctuated between $102.7K and $109K, exhibiting a volatile, range-bound behavior[16]. It’s like watching a dance where the steps are unpredictable, and the rhythm keeps changing.

Technical Analysis

Key Support and Resistance Levels

The recent price action highlights the importance of key support and resistance levels. The $106.5K level has proven to be a significant barrier, with bears successfully defending it. The next critical support level is at $103.3K, which is currently under pressure. A breach of this level could lead to further downside, potentially pushing Bitcoin below the $100K mark[REF]1,2[/REF].

Market Sentiment

Market sentiment plays a crucial role in Bitcoin’s price movements. The recent defense of the $106.5K level by bears indicates a bearish sentiment, with traders anticipating further downside. However, the persistent inflows into Bitcoin and Ethereum suggest that institutional investors remain bullish on the long-term prospects of cryptocurrencies[REF]7,17[/REF].

Broader Market Factors

Federal Reserve Policies

The Federal Reserve’s decision to hold interest rates steady has had a calming effect on traditional markets. However, the discord among Fed officials, as indicated by the dot plot, suggests underlying uncertainties. These uncertainties could spill over into the cryptocurrency market, influencing Bitcoin’s price movements[REF]7,17[/REF].

Global Economic Conditions

Global economic conditions, including inflation and tariff risks, continue to impact market dynamics. While Bitcoin has historically been seen as a hedge against inflation, the current economic environment adds another layer of complexity. Investors are closely monitoring these factors, which could influence their trading decisions and, consequently, Bitcoin’s price[7].

Altcoins and Forks

The Diversification Wave

While Bitcoin remains the focal point, altcoins and forks are also making waves. Bitcoin Cash (BCH) and Bitcoin SV (BSV) have shown significant price movements, outpacing Bitcoin in some instances. This highlights the diversification within the cryptocurrency market and the potential for altcoins to capture market share[REF]8,10,11[/REF].

Long-Term Patterns and Cycles

The Decade-Long Journey

Looking at the broader picture, Bitcoin’s price evolution over the past decade reveals several distinct market cycles and patterns. These cycles are characterized by periods of rapid price appreciation followed by corrections. Understanding these patterns can provide valuable insights into Bitcoin’s long-term trajectory and potential future price movements[18].

Conclusion: Navigating the Volatile Waters

Bitcoin’s recent price movements underscore the volatility and complexity of the cryptocurrency market. While technical indicators and market sentiment provide valuable insights, broader economic factors and global events also play a significant role. As investors navigate these turbulent waters, it is essential to stay informed and adaptable. The future of Bitcoin remains uncertain, but one thing is clear: it continues to captivate and challenge investors worldwide.