Navigating the Cryptocurrency Market: A Deep Dive into Recent Trends and Insights

The cryptocurrency market is a rollercoaster of volatility, where fortunes can shift in the blink of an eye. Recent data from Sentora, a leading DeFi analytics platform, suggests that Bitcoin (BTC) may be heading for a price correction. This analysis explores the factors driving these fluctuations, the implications for investors, and key strategies to navigate the market effectively.

—

Understanding the Recent Bitcoin Price Drop

Why Is Crypto Dropping Today?

The cryptocurrency market has recently witnessed significant downturns, particularly in Bitcoin and Ethereum (ETH). Several factors contribute to these movements:

Correction or Start of a Downtrend?

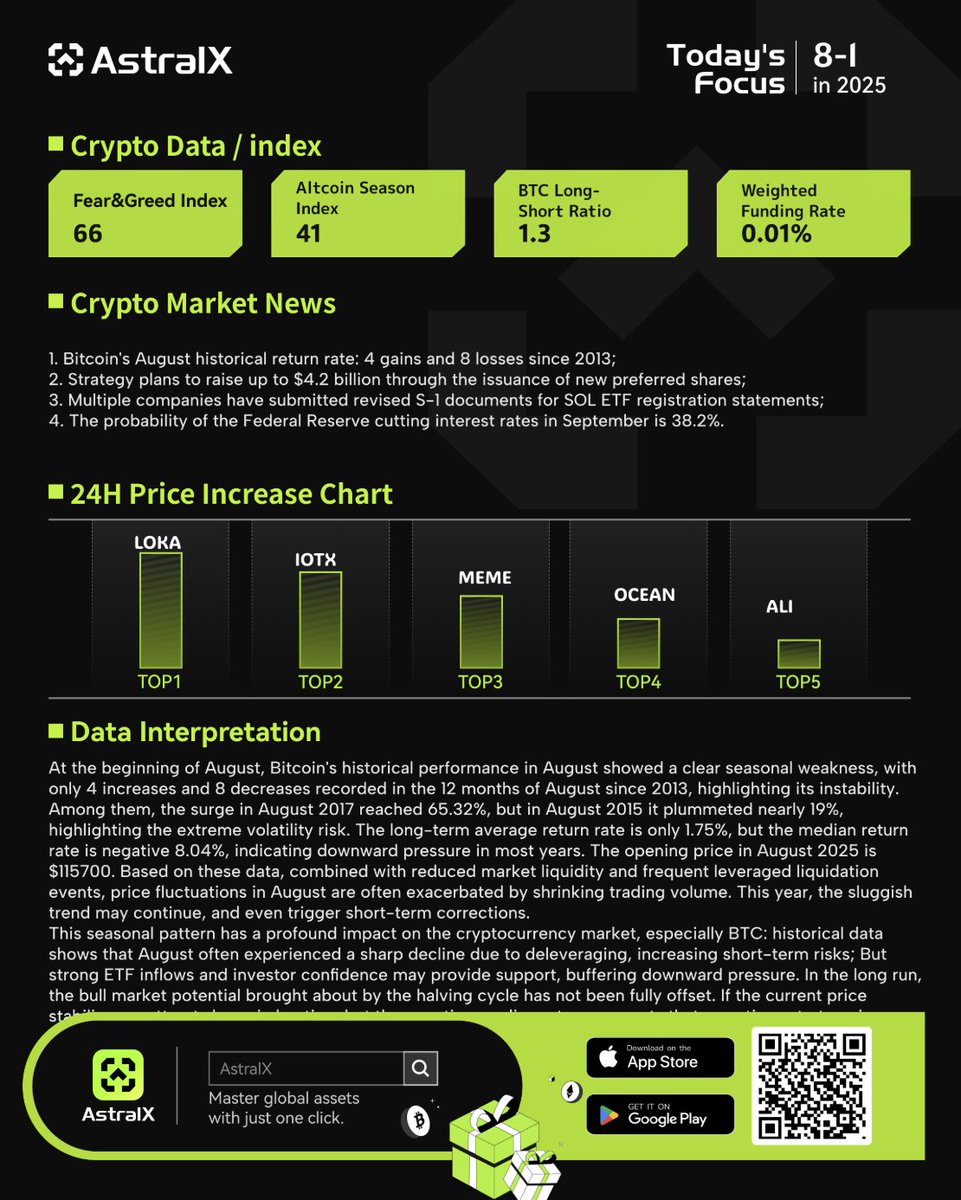

Analysts remain divided on whether the current dip is a temporary correction or the beginning of a prolonged downtrend. Historical data shows that Bitcoin has experienced more losses than gains in August since 2013, with a 4:8 win-loss ratio. This suggests caution is warranted.

—

Key Market Indicators and Trader Signals

Technical Analysis: What the Charts Are Saying

– Bitcoin’s Support Levels – The recent drop below $115,000 is a critical psychological barrier. If BTC fails to reclaim this level, further declines may follow.

– Lista DAO (LISTA) Performance – Despite a strong uptrend in recent months (+41.05% in 60 days, +62.63% in 90 days), LISTA is now facing resistance, signaling potential consolidation.

On-Chain Data Insights

– Exchange Inflows – Increased inflows into exchanges suggest higher selling pressure, as traders move assets to liquidate.

– Derivatives Market – Rising open interest in futures contracts indicates heightened speculative activity, which can amplify volatility.

—

Should You Buy Now or Wait?

Factors to Consider Before Investing

Strategies for Traders

– Dollar-Cost Averaging (DCA) – A long-term strategy to mitigate volatility by investing fixed amounts over time.

– Stop-Loss Orders – Essential for risk management, preventing significant losses during sudden downturns.

– Diversification – Spreading investments across multiple assets reduces exposure to a single market downturn.

—

The Rise of Meme Coins: Pepe Coin ($PEPE) Analysis

While Bitcoin and Ethereum dominate headlines, meme coins like Pepe Coin ($PEPE) continue to attract attention. Launched in 2023, PEPE thrives purely on community hype and internet culture rather than utility. Its price movements are highly speculative, making it a high-risk, high-reward asset.

—

Conclusion: Navigating the Crypto Market with Confidence

The cryptocurrency market remains unpredictable, but with the right tools and strategies, investors can make informed decisions. Whether you’re a long-term holder or a short-term trader, staying updated on market trends, technical analysis, and macroeconomic factors is essential.

As the market evolves, so should your strategies. Keep an eye on key indicators, manage risk effectively, and stay adaptable to changing conditions. The future of crypto is bright, but only for those who navigate its waters wisely.

—

Sources

Stay informed, stay cautious, and happy trading! 🚀