The summer of 2025 presents a fascinating economic landscape in the United States, where the interplay between monetary policy, political pressures, and market expectations creates a complex dynamic. At the heart of this scenario is the diminishing likelihood of a July interest rate cut by the Federal Reserve, a development that reflects both economic realities and the growing tension between the Fed and the Trump administration. This report examines the factors contributing to the fading prospects of a July rate cut, the contrasting approaches of the Fed and the White House, and the broader implications for the economy and financial markets.

Powell’s Data-Dependent Approach and Inflation Concerns

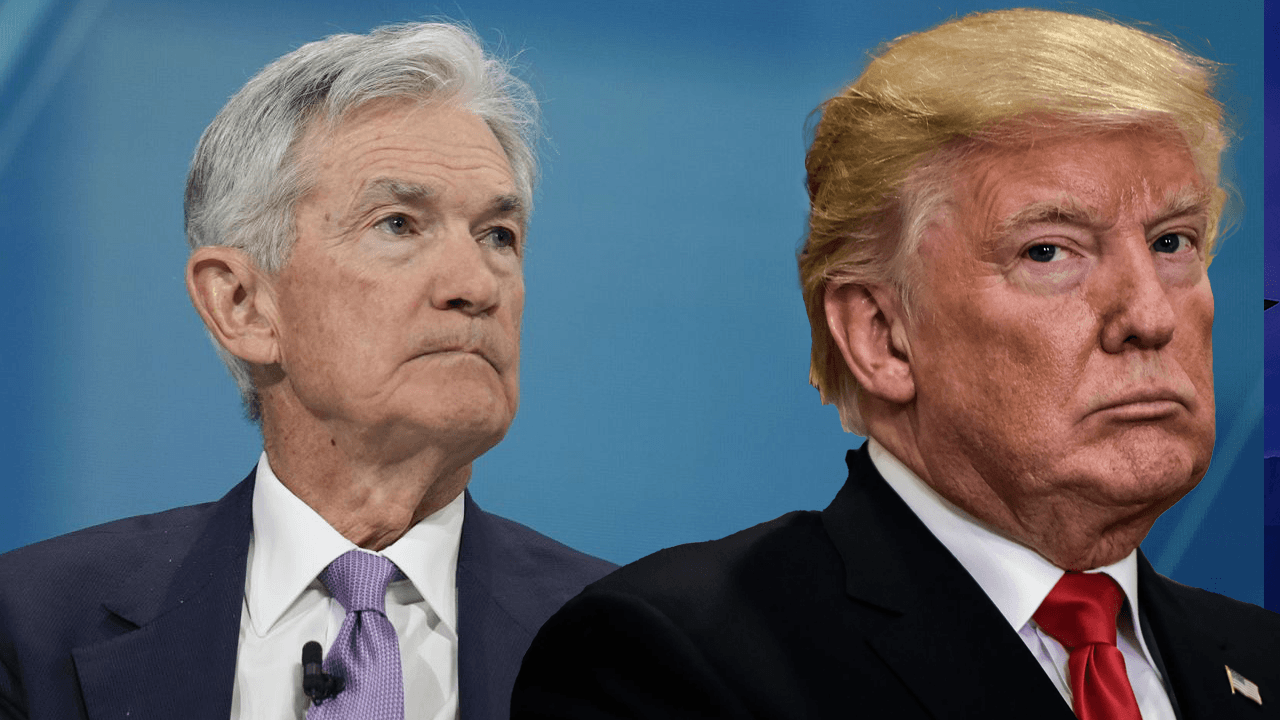

Jerome Powell, the Chair of the Federal Reserve, has consistently advocated for a data-dependent monetary policy. This approach prioritizes economic indicators such as inflation, employment, and GDP growth to guide interest rate decisions. Powell’s recent testimony before Congress reinforced this stance, emphasizing the need to maintain steady rates in the face of persistent inflation. The Fed’s cautious approach is particularly relevant given the inflationary pressures stemming from President Trump’s tariff policies.

Tariffs, by increasing the cost of imported goods, contribute to higher consumer and business prices, thereby fueling inflation. Powell has acknowledged the potential long-term effects of tariffs on inflation, further justifying the Fed’s reluctance to cut rates prematurely. The Fed is closely monitoring the situation, recognizing that the coming months will be critical in assessing the full impact of tariffs on inflation. However, July may be too soon to draw definitive conclusions, making a rate cut in that month unlikely.

The Fed’s dilemma is compounded by the mixed signals from the economy. While the labor market remains robust, with unemployment near historic lows, other sectors show signs of slowing growth. Manufacturing activity has weakened, business investment has been sluggish, and the housing market has cooled in response to higher interest rates. These conflicting signals make it challenging for the Fed to determine the appropriate policy response. The central bank must carefully balance the risks of cutting rates too soon, which could exacerbate inflation, against the risks of keeping rates too high, which could stifle economic growth.

Trump’s Advocacy for Immediate Rate Cuts

In contrast to the Fed’s measured approach, President Trump has been a vocal advocate for immediate and substantial interest rate cuts. Trump believes that lower rates would stimulate economic growth, boost employment, and further fuel the stock market rally. He has publicly criticized the Fed’s current policy, accusing the central bank of hindering economic progress.

Trump’s push for lower rates is motivated by a combination of political and economic factors. Politically, he sees a strong economy as essential for his re-election prospects. By lowering interest rates, he hopes to create a more favorable economic environment ahead of future elections. Economically, Trump believes that lower rates would weaken the dollar, making U.S. exports more competitive and reducing the trade deficit.

The tension between the Fed and the Trump administration is not new. Throughout his presidency, Trump has repeatedly clashed with the Fed over monetary policy, often publicly criticizing Powell and other Fed officials. These clashes have raised concerns about the Fed’s independence and the potential for political interference in monetary policy decisions. The Fed’s ability to resist such pressures will be crucial in maintaining its credibility and ensuring long-term economic stability.

Market Expectations and Shifting Sentiment

Initially, markets had priced in a relatively high probability of a July rate cut. However, as Powell and other Fed officials have reiterated their commitment to data dependence and inflation control, market expectations have shifted. Fixed income markets now see only a small chance of an interest rate cut at the July meeting, with the probability hovering around 5%. This suggests that investors are increasingly aligned with the Fed’s cautious stance.

The shift in market sentiment reflects a growing recognition of the complexities facing the Fed. While economic growth has remained relatively strong, inflation has proven more persistent than initially anticipated. The Fed must carefully balance the risks of cutting rates too soon, which could fuel inflation, against the risks of keeping rates too high, which could stifle economic growth.

Some analysts suggest that markets are bullish on Trump’s second term, hoping for further tax cuts and accelerated growth, but this sentiment hasn’t translated to expectations for a July cut. Instead, investors appear to be adopting a wait-and-see approach, recognizing that the Fed’s decisions will be guided by incoming data rather than political pressures.

The Fed’s Dilemma: Navigating Mixed Signals

The Fed’s data-dependent approach is further complicated by the mixed signals coming from the economy. On one hand, the labor market remains strong, with unemployment rates near historic lows. Consumer spending is also holding up relatively well, supported by rising wages and strong consumer confidence.

On the other hand, there are signs that economic growth is slowing. Manufacturing activity has weakened, and business investment has been sluggish. The housing market has also cooled off in response to higher interest rates. These conflicting signals make it difficult for the Fed to determine the appropriate course of action.

The Fed’s dilemma is further compounded by global economic uncertainties. The ongoing trade disputes between the U.S. and other countries, including China, Canada, and Mexico, are creating uncertainty and weighing on global growth. A slowdown in the global economy could have knock-on effects on the U.S. economy, making the Fed even more cautious about cutting rates.

Alternative Scenarios: Looking Beyond July

While a July rate cut appears increasingly unlikely, the possibility of easing later in the year remains on the table. The Fed has signaled that it is prepared to adjust its policy stance if economic conditions warrant. If inflation begins to moderate and economic growth slows more significantly, the Fed could consider cutting rates at subsequent meetings. Some analysts predict potential easing in 2025 or beyond, depending on the data.

Another potential scenario is that the Fed could hold rates steady for an extended period. If inflation remains stubbornly high and economic growth remains resilient, the Fed may choose to wait and see how the economy evolves before making any further policy changes. This would be particularly likely if the Fed believes that the impact of tariffs on inflation is likely to be temporary.

A Complex Landscape

Ultimately, the Fed’s decision on interest rates will depend on a complex interplay of factors, including inflation, economic growth, market expectations, and global economic conditions. The Fed must navigate this complex landscape carefully, balancing the risks of both premature easing and excessive tightening. President Trump is considering a federal takeover of Washington, DC, but that possibility will likely have little bearing on the Fed’s independence.

The fading prospects of a July rate cut highlight the ongoing tension between political pressures and the Fed’s commitment to data-driven decision-making. As President Trump continues to advocate for lower rates, the Fed faces a critical test of its independence. The central bank must remain steadfast in its commitment to price stability and sustainable economic growth, even in the face of political pressure. The outcome of this conflict will have significant implications for the U.S. economy. A premature rate cut could fuel inflation and destabilize financial markets. Conversely, keeping rates too high could stifle economic growth and lead to a recession. The Fed’s ability to navigate this complex landscape will be crucial for ensuring the long-term health and prosperity of the U.S. economy. Only time will tell if the Fed can maintain its independence and make the right decisions for the economy.