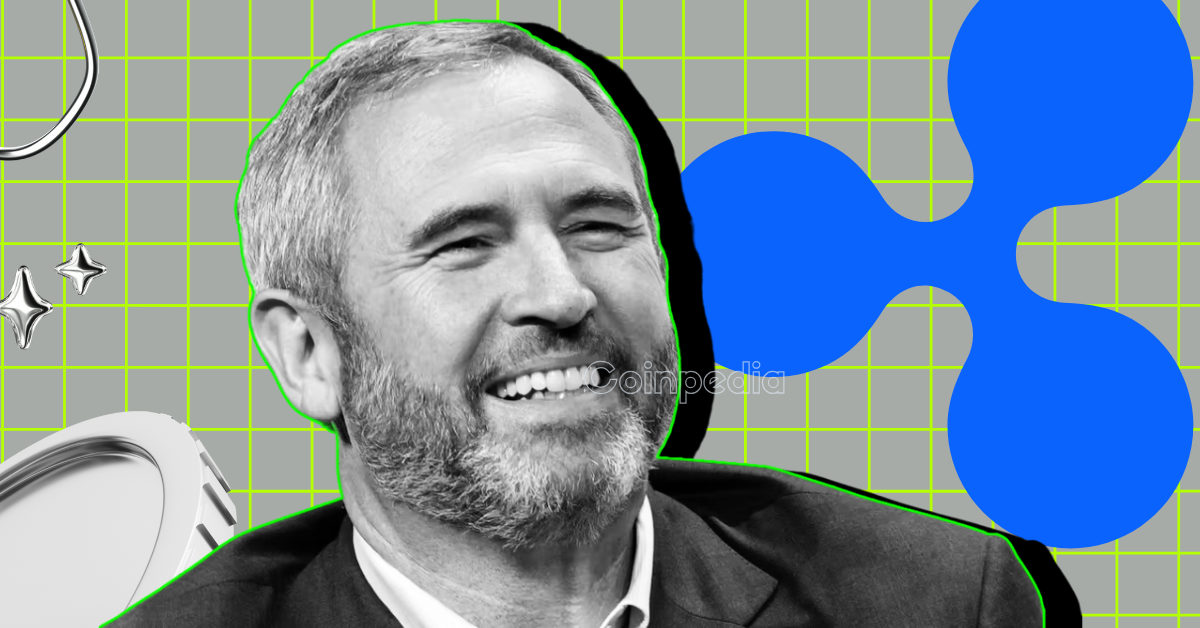

The crypto world is on the cusp of a significant milestone as July 9, 2025, approaches. On this day, Brad Garlinghouse, the CEO of Ripple, will testify before the U.S. Senate Banking Committee in a hearing titled “From Wall Street to Web3: Building Tomorrow’s Digital Asset Markets.” This event marks a critical juncture in the ongoing efforts to establish a clear and comprehensive regulatory framework for the crypto industry in the United States. The stakes are high, and the outcome of this hearing could shape the future of digital assets for years to come.

The Urgency of Regulatory Clarity

The core message Garlinghouse intends to deliver is the urgent need for regulatory clarity within the crypto space. For years, the industry has operated under a cloud of uncertainty, navigating a complex web of conflicting interpretations and ambiguous guidelines. This lack of clarity has stifled innovation, hindered institutional investment, and left consumers vulnerable to potential scams and market manipulation.

Garlinghouse has been a vocal advocate for well-defined rules, arguing that they are essential for fostering innovation, protecting consumers, and preventing the exodus of crypto companies to more welcoming jurisdictions. In fact, he has stated that a significant portion of Ripple’s hiring will occur outside the U.S. due to this regulatory ambiguity, highlighting the tangible impact of the current environment. The absence of clear regulations has created a challenging landscape for crypto businesses, forcing them to operate in a state of constant uncertainty. This regulatory vacuum has not only impeded growth but also raised concerns about the long-term viability of the U.S. as a hub for crypto innovation.

Key Legislative Considerations

The Senate hearing takes place amidst ongoing efforts to modernize market rules for crypto assets. Lawmakers are actively exploring various legislative proposals aimed at providing the much-needed clarity the industry craves. Key crypto bills like the CLARITY Act are under consideration, designed to define crypto rules more precisely in law.

One of the primary goals of this legislation is to clarify the classification of digital assets, specifically distinguishing between securities and commodities. The SEC and CFTC have been engaged in a tug-of-war over regulatory jurisdiction, leading to confusion and uncertainty for businesses operating in the crypto space. The new legislation aims to delineate the responsibilities of each agency, providing a clear roadmap for compliance. This distinction is crucial for determining which regulatory framework applies to different types of digital assets, ensuring that businesses can operate within a clear and consistent legal environment.

Another crucial aspect of the proposed legislation is the consistent application of securities laws. Garlinghouse is expected to advocate for a fair and consistent approach to regulating digital assets, ensuring that similar assets are treated equally under the law. He will likely emphasize the importance of distinguishing between utility tokens and other types of digital assets, arguing that not all tokens should be subject to the same stringent regulations as securities. This nuanced approach is essential for fostering innovation while maintaining investor protection.

The Broader Implications for the Crypto Industry

The outcome of this Senate hearing has far-reaching implications for the entire crypto industry. A clear and comprehensive regulatory framework would not only provide much-needed certainty for businesses but also pave the way for increased institutional adoption and mainstream acceptance of digital assets.

With clear guidelines in place, institutional investors would be more likely to allocate capital to the crypto market, driving liquidity and fostering further innovation. This, in turn, would benefit consumers by providing access to a wider range of crypto products and services, while also enhancing investor protection. The potential for increased institutional investment cannot be overstated, as it would bring a new level of stability and credibility to the crypto market. Conversely, failure to achieve regulatory clarity could further stifle innovation and drive businesses overseas, diminishing the United States’ position as a leader in the digital asset space. It could also perpetuate the existing climate of uncertainty, leaving consumers vulnerable to potential risks and scams.

XRP Holders and the Regulatory Landscape

The hearing also holds particular significance for XRP holders, who have been closely following the legal battle between Ripple and the SEC. The SEC’s lawsuit against Ripple has cast a shadow over XRP, creating uncertainty about its regulatory status.

XRP holders are hopeful that the Senate hearing will help resolve the long-standing regulatory confusion surrounding XRP and provide greater clarity on its classification. A favorable outcome could boost confidence in XRP and potentially lead to increased adoption and price appreciation. The resolution of this legal battle is crucial for the future of XRP, as it will determine the token’s regulatory status and its potential for growth in the U.S. market.

Garlinghouse’s Testimony: A Balancing Act

In his testimony, Garlinghouse faces the delicate task of advocating for regulatory clarity while also emphasizing the importance of fostering innovation and avoiding overly burdensome regulations. He must strike a balance between protecting consumers and enabling the industry to thrive.

He is expected to highlight the potential benefits of blockchain technology and digital assets, emphasizing their ability to improve financial inclusion, reduce transaction costs, and create new economic opportunities. He will likely argue that a well-designed regulatory framework can unlock these benefits while mitigating potential risks. Garlinghouse’s testimony will be a critical opportunity to showcase the positive impact of blockchain technology and digital assets on the global economy.

Garlinghouse will also likely address concerns about money laundering and other illicit activities, emphasizing the industry’s commitment to combating these issues. He may propose specific measures that can be implemented to enhance transparency and prevent the use of digital assets for illegal purposes. This proactive approach is essential for building trust with regulators and the public, demonstrating the industry’s commitment to responsible innovation.

Beyond Ripple: A United Industry Front

Garlinghouse will not be alone in addressing the Senate Banking Committee. Other leading figures from the crypto sector, including Chainalysis CEO Jonathan Levin, are also scheduled to testify. This unified front demonstrates the industry’s collective commitment to working with lawmakers to establish a clear and comprehensive regulatory framework.

These industry leaders will likely echo Garlinghouse’s call for regulatory clarity, emphasizing the importance of fostering innovation, protecting consumers, and preventing the exodus of crypto companies to other jurisdictions. They may also offer specific recommendations on how to best regulate the crypto market, drawing on their expertise and experience in the industry. This collaborative effort is crucial for presenting a cohesive and well-informed perspective to lawmakers, increasing the likelihood of meaningful regulatory progress.

A Moment of Truth

The Senate hearing on July 9, 2025, represents a moment of truth for the crypto industry in the United States. It is an opportunity for lawmakers to hear directly from industry leaders about the challenges and opportunities facing the sector and to begin forging a path towards a clear and comprehensive regulatory framework.

The stakes are high, and the outcome of this hearing will have a profound impact on the future of the crypto industry in the United States. Whether it becomes a catalyst for innovation and growth or a setback that stifles progress remains to be seen. The decisions made during this hearing could set the tone for the future of digital assets in the U.S., influencing not only the immediate regulatory landscape but also the long-term trajectory of the industry.

The Dawn of a New Era?

As Brad Garlinghouse prepares to address the Senate Banking Committee, the crypto world anticipates the potential dawn of a new era. An era defined by clarity, innovation, and responsible growth. The decisions made on July 9, 2025, could shape the future of digital assets for years to come, influencing not only the U.S. market but also setting a precedent for global regulation. The journey from Wall Street to Web3 is underway, and the Senate hearing may well be the compass guiding its direction. The outcome of this hearing could mark a turning point for the crypto industry, determining whether the U.S. will remain a leader in digital asset innovation or fall behind other jurisdictions with more favorable regulatory environments.