The Ever-Changing Landscape of Bitcoin

Imagine a digital gold rush, where the gold is not buried in the ground but hidden in lines of code. This is the world of Bitcoin, a cryptocurrency that has journeyed from obscurity to the forefront of financial innovation. As we stand in 2025, Bitcoin’s landscape is more vibrant and dynamic than ever, with technological advancements and market trends shaping its future.

The Rise of Decentralized Finance (DeFi)

Layer 2 Solutions: Enhancing P2P Lending

Decentralized Finance, or DeFi, is revolutionizing the way we think about financial services. Unlike traditional banking, DeFi platforms operate without intermediaries, using blockchain technology to facilitate peer-to-peer (P2P) transactions. This shift towards decentralization is not just a fad; it’s a fundamental change in how we handle money.

One of the most exciting developments in the Bitcoin ecosystem is the growth of Layer 2 solutions. These solutions, such as the Lightning Network, operate on top of the main Bitcoin blockchain, enabling faster and cheaper transactions. This innovation is crucial for scaling Bitcoin and making it more accessible for everyday use. For instance, Layer 2 solutions can enhance P2P lending by reducing transaction costs and increasing speed, making it more attractive for users [1].

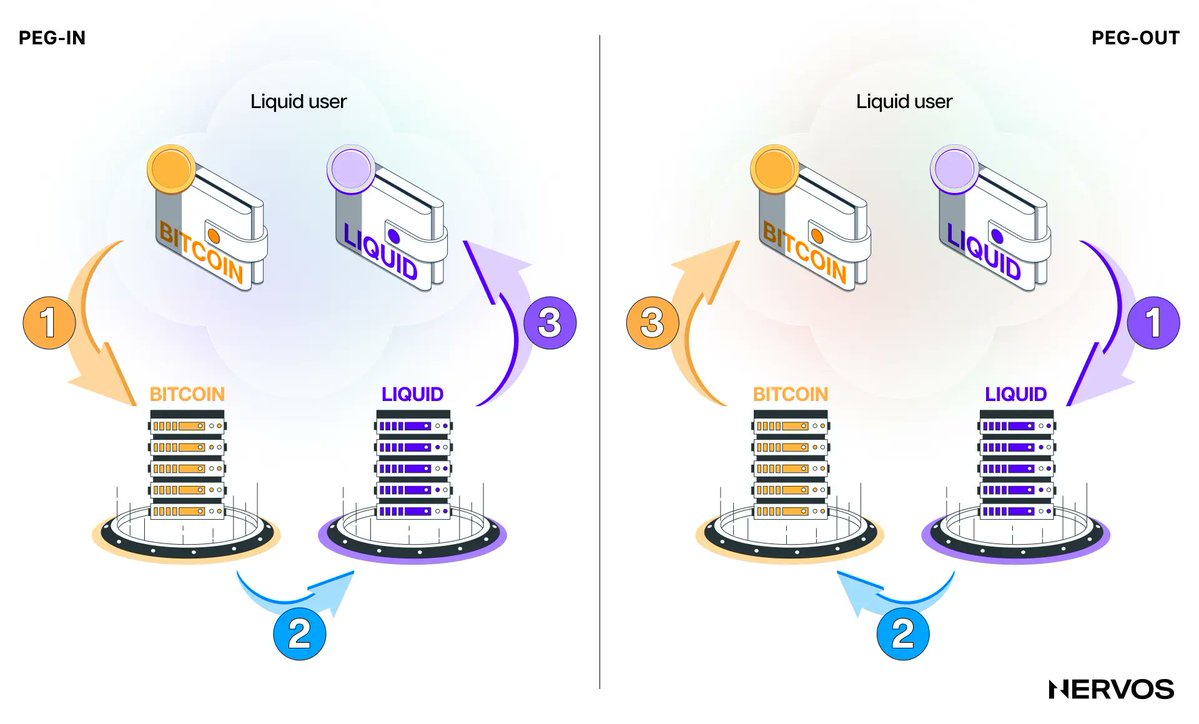

Navigating Cross-Chain Possibilities

As the DeFi landscape evolves, navigating cross-chain possibilities becomes increasingly important. Cross-chain interoperability allows different blockchain networks to communicate and interact with each other, enabling the seamless transfer of assets and data. This interoperability is essential for creating a more integrated and efficient financial ecosystem. For Bitcoin, this means exploring ways to interact with other blockchain networks, such as Ethereum, to leverage their smart contract capabilities and expand the range of financial services available [1].

Technical Analysis: Bullish Momentum and Market Trends

Breaking Out of the Falling Wedge Pattern

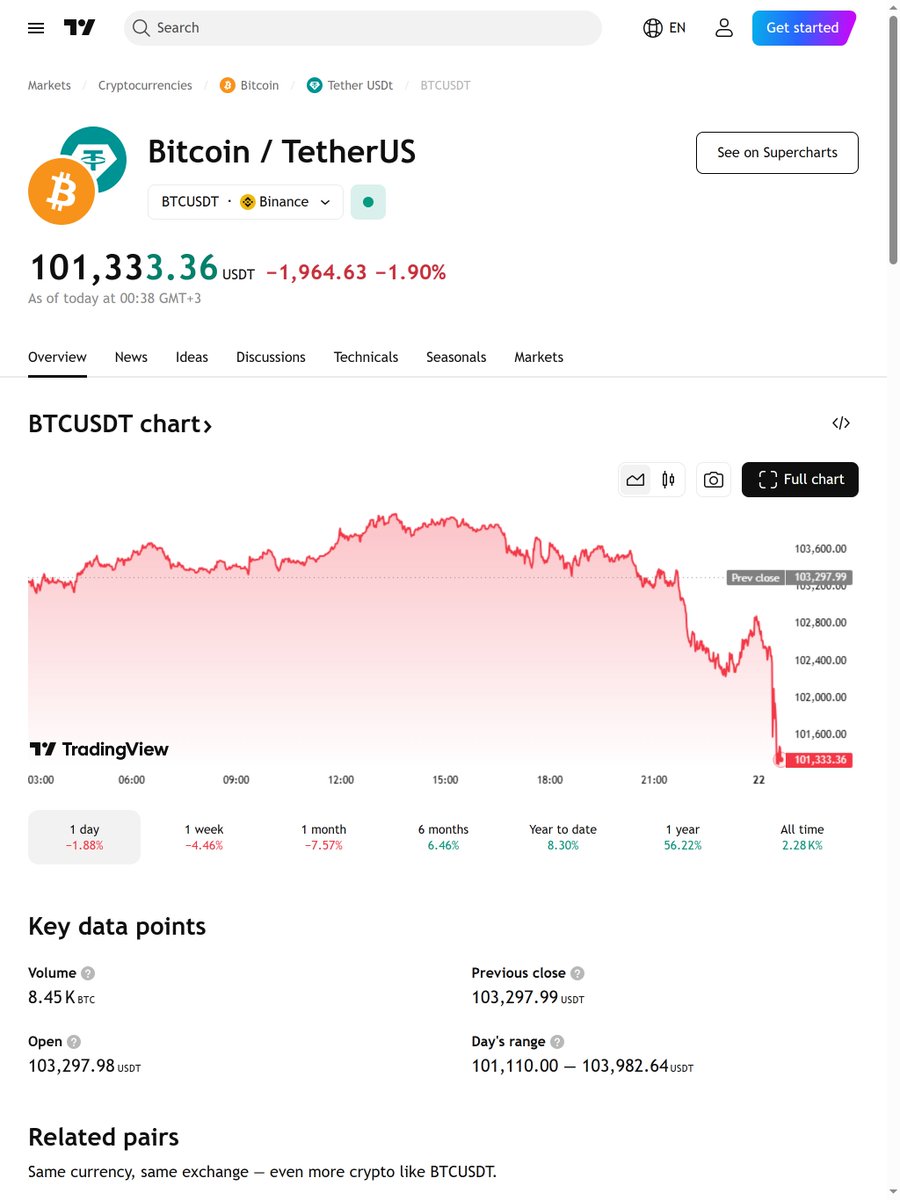

Technical analysis is a powerful tool for understanding Bitcoin’s price movements and market trends. Recently, Bitcoin has broken out of a falling wedge pattern with significant volume, indicating bullish momentum. A falling wedge pattern typically signals a reversal in a downtrend, and the breakout suggests that Bitcoin is poised for upward movement. A successful retest of the breakout zone would confirm this bullish trend, making it an exciting time for crypto enthusiasts [2].

Key Support and Resistance Levels

Understanding key support and resistance levels is crucial for predicting Bitcoin’s future price movements. Support levels are price points where buying pressure is strong enough to prevent the price from falling further, while resistance levels are where selling pressure is strong enough to prevent the price from rising. Analyzing these levels can help investors make informed decisions and optimize their portfolios. For instance, identifying macro support and resistance levels can provide a clearer picture of Bitcoin’s potential price range and help investors navigate market volatility [5].

Bitcoin vs. Gold: A Historical Evolution

Safe Havens in a Volatile Market

Bitcoin and gold have often been compared as safe havens in volatile markets. Both assets have historically been seen as stores of value, providing protection against inflation and economic uncertainty. However, their historical evolutions and market dynamics differ significantly. Bitcoin, being a digital asset, benefits from technological advancements and increasing adoption, while gold has a long-standing reputation as a tangible asset. Gain insights from detailed market analysis to optimize your portfolio and make smarter decisions with key data [8].

Optimizing Your Portfolio

Investors often consider diversifying their portfolios with both Bitcoin and gold to balance risk and reward. While Bitcoin offers the potential for high returns, it is also more volatile. Gold, on the other hand, provides stability but may not offer the same level of growth. By understanding the historical evolution and market dynamics of both assets, investors can make more informed decisions and optimize their portfolios for better performance [8].

The Future of Bitcoin: Projections and Opportunities

Bullish Projections and Market Sentiment

The future of Bitcoin looks promising, with bullish projections and positive market sentiment. As more institutions and individuals adopt Bitcoin, its value and utility are likely to increase. The ongoing development of Layer 2 solutions and cross-chain interoperability will further enhance Bitcoin’s scalability and functionality, making it a more attractive option for a wider range of users [1].

Opportunities for Investors

For investors, the current landscape presents numerous opportunities. Whether it’s through direct investment in Bitcoin, participation in DeFi platforms, or leveraging technical analysis to make informed trading decisions, there are multiple avenues to explore. The key is to stay informed, adapt to market changes, and take advantage of the evolving technologies and trends in the Bitcoin ecosystem [1, 2, 5, 8].

Conclusion: Embracing the Future of Bitcoin

As we look ahead, it is clear that Bitcoin’s journey is far from over. The innovations in DeFi, the potential of Layer 2 solutions, and the increasing importance of cross-chain interoperability are all shaping the future of this groundbreaking technology. For investors, enthusiasts, and technologists, the opportunities are vast and exciting. Embracing these changes and staying informed will be crucial for navigating the dynamic landscape of Bitcoin and capitalizing on its potential.

—

Sources: