Introduction

Imagine stepping into a bustling marketplace where fortunes can be made or lost in the blink of an eye. Welcome to the cryptocurrency market of 2025, a landscape as dynamic as it is unpredictable. As of March 28, 2025, the market is a whirlwind of volatility, with key cryptocurrencies showcasing distinct patterns that offer a glimpse into the current market sentiment. This analysis will explore the technical indicators and price movements of prominent cryptocurrencies, providing a comprehensive overview of the market’s direction and potential future developments.

Bearish Continuation Patterns

$EPAY: Trapped Below Major Moving Averages

In the volatile world of cryptocurrencies, $EPAY stands out as a prime example of a bearish continuation pattern. Trapped below all major moving averages (MAs), $EPAY has seen its 171.93% pump significantly fade, forming a series of lower highs. This downtrend structure remains intact, with the price consistently failing to break above the MA20. The persistent rejection at key resistance levels indicates that sellers are in control, and a further decline is likely unless a significant bullish catalyst emerges[1].

$STRK: Struggling to Maintain Support

$STRK is another cryptocurrency exhibiting a bearish continuation pattern. After rejection at the MA50, $STRK has formed a clear lower high on the daily timeframe, struggling to maintain support at $0.16. Currently trading below all major moving averages, the MA50 at $0.20 is acting as a strong resistance level. The inability to break above this level suggests a bearish bias, with the potential for further downside movement[5].

Struggling to Maintain Momentum

$BTC: Rejection at Key Resistance

Bitcoin, the flagship cryptocurrency, is facing challenges in maintaining its momentum. After rejecting the MA50 at $89,533, Bitcoin is currently trading at $84,315, forming lower highs since the recent peak. This bearish structure, with the price sitting below all major moving averages, suggests a lack of bullish conviction. The inability to break above key resistance levels indicates that sellers are dominant, and a further decline is possible[2].

$AIXBT: Potential Short-Term Relief

$AIXBT presents a bearish bias with potential short-term relief. The price action shows a clear downtrend, with the price trading below all major MAs. Recent candles have formed a potential falling wedge pattern, accompanied by slight positive divergence on volume. The MA50 at $0.17 is acting as strong resistance, but the falling wedge pattern suggests a potential short-term relief rally. However, the overall bearish trend remains intact, and caution is advised[3].

Stabilization and Consolidation

$BTC: Stabilization at Support Levels

Bitcoin is showing signs of stabilization at $84,381 after a recent rejection from the $88K resistance. Currently consolidating above the MA20 ($84,107), which is providing immediate support, the price is trading below both the MA50 and MA200. This consolidation phase indicates a period of indecision, with neither bulls nor bears gaining a clear advantage. The downtrend from the all-time high (ATH) remains intact, with lower highs established. A break above the MA50 could signal a potential reversal, but until then, the bearish bias persists[4].

NFT Market Analysis

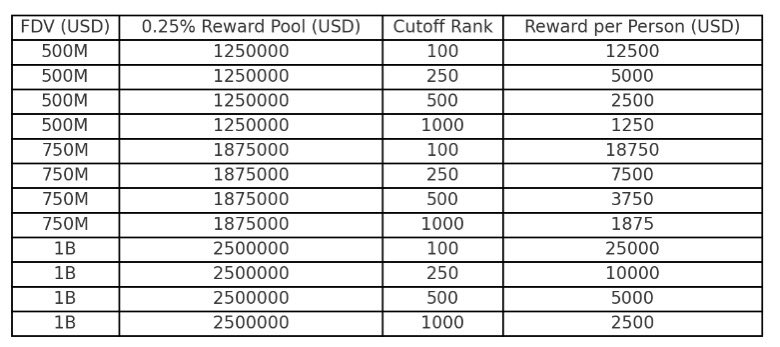

$Drop3io NFT: Profitability at Token Generation Event (TGE)

The NFT market continues to evolve, with unique dynamics influencing price movements. For instance, if a $Drop3io NFT, worth 0.25 SOL (approximately $32.25), is equivalent to 30,000 tokens, it must list above $0.001075 to profit NFT purchasers at the Token Generation Event (TGE). This calculation highlights the importance of understanding the underlying value and potential profitability of NFTs, which can significantly impact investor decisions[6].

Conclusion

Navigating the Bearish Landscape

The cryptocurrency market in 2025 is a challenging terrain, characterized by bearish continuation patterns and struggles to maintain momentum. Key cryptocurrencies like $EPAY, $STRK, and $BTC are exhibiting clear downtrend structures, with price movements trapped below major moving averages. While there are signs of potential short-term relief and stabilization, the overall bearish bias remains intact. Investors and traders must exercise caution and conduct thorough analysis to navigate this challenging landscape. The NFT market adds another layer of complexity, with unique valuation metrics influencing investor decisions. As the market continues to evolve, staying informed and adaptable will be crucial for success.