The Cryptocurrency Market in 2025: A Deep Dive

Imagine stepping into a bustling marketplace where fortunes are made and lost in the blink of an eye. Welcome to the cryptocurrency market in 2025, a landscape teeming with potential reversals, significant investments, and emerging trends. Let’s embark on a journey to explore the key developments and analyses shaping this dynamic arena.

A Snapshot of the Current Market

The cryptocurrency market in 2025 is a whirlwind of activity, with various tokens and trends capturing the attention of investors and enthusiasts alike. From potential reversals to significant investments, the landscape is dynamic and ever-changing. Let’s dive into some of the key developments and analyses that are shaping the market today.

The Double Bottom Pattern: A Glimmer of Hope

One of the most intriguing developments is the double bottom pattern observed in certain cryptocurrencies. For instance, $DOT has shown early signs of a potential reversal after forming a double bottom pattern at $4.20. This pattern is a bullish reversal indicator, suggesting that the price may soon bounce back. However, it’s crucial to note that the price has closed above the MA20 ($4.30) but remains below both MA50 ($4.64) and MA200 ($5.60), indicating that we are still in a macro bearish trend. This duality presents a fascinating scenario for traders, who must navigate the delicate balance between short-term optimism and long-term caution.

The double bottom pattern is a technical analysis tool that traders use to identify potential reversals in the market. When a cryptocurrency forms a double bottom, it means that the price has hit a low point twice before rebounding. This pattern is often seen as a bullish signal, indicating that the price may be poised for an upward movement. However, it’s essential to consider other factors, such as moving averages, to get a more comprehensive view of the market’s direction.

Whales and Major Moves

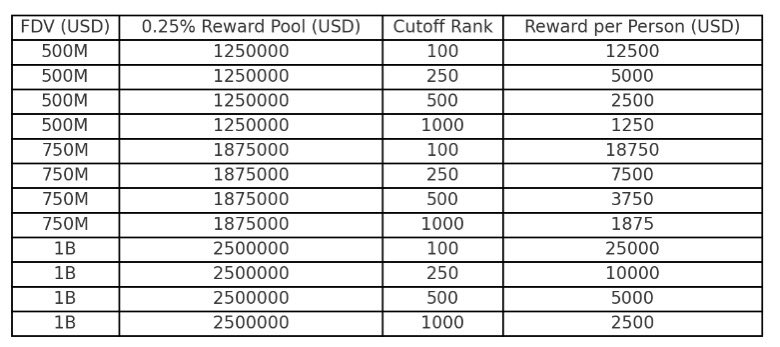

The market is also witnessing significant moves by major players. Ethereum (ETH) whales are accumulating despite a 51% price drop, a strategy that could indicate confidence in the long-term value of ETH. This accumulation by whales is a crucial indicator, as their actions often precede significant market movements. Additionally, Haun Ventures is raising $1 billion for new crypto funds, a clear sign of institutional interest and investment in the sector. This influx of capital could provide a much-needed boost to the market, potentially leading to a bullish trend.

Whales, or large investors, play a significant role in the cryptocurrency market. Their actions can influence the market’s direction, and their accumulation of a particular cryptocurrency often signals confidence in its long-term value. The recent moves by ETH whales and the raising of new crypto funds by Haun Ventures are positive signs for the market, indicating that institutional investors are bullish on the sector’s future.

The Quest for Transparency

Transparency and trust are paramount in the cryptocurrency world, and Tether’s recent move to seek a full audit from a “Big Four” firm is a step in the right direction. This audit could enhance confidence in Tether, one of the most widely used stablecoins, and set a precedent for other cryptocurrencies to follow. The market’s reaction to this move will be telling, as increased transparency could lead to greater adoption and stability.

Tether, a stablecoin pegged to the US dollar, has faced scrutiny in the past due to concerns about its reserves and transparency. The recent move by Tether to seek a full audit from a “Big Four” firm is a positive development, as it could enhance confidence in the stablecoin and set a precedent for other cryptocurrencies to follow. Increased transparency in the cryptocurrency market is essential for greater adoption and stability, and Tether’s move is a step in the right direction.

The Bitcoin Dip: A Temporary Setback?

Analysis suggests that the current Bitcoin dip may last 90 days. This prediction is based on historical data and market trends, but it’s essential to remember that the cryptocurrency market is notoriously volatile. A 90-day dip could present opportunities for investors to buy at lower prices, but it also comes with risks. Traders must stay vigilant and adapt their strategies accordingly.

Bitcoin, the world’s largest cryptocurrency by market capitalization, has experienced several dips in the past. The current dip, which is predicted to last 90 days, could present opportunities for investors to buy at lower prices. However, it’s essential to remember that the cryptocurrency market is notoriously volatile, and traders must stay vigilant and adapt their strategies accordingly.

Emerging Trends and Opportunities

The Rise of NFTs and Digital Assets

The NFT (Non-Fungible Token) and digital asset space is evolving rapidly, and bitsCrunch ($BCUT) is positioning itself as a key player. The future prospects of $BCUT are promising, with market trends indicating a growing demand for NFTs and digital assets. As the technology behind NFTs continues to advance, bitsCrunch could play a significant role in shaping the future of this market. Investors should keep an eye on developments in this space, as it presents unique opportunities for growth and innovation.

NFTs, or non-fungible tokens, have gained significant attention in recent years. These digital assets are unique and cannot be replaced on a like-for-like basis, making them highly sought after by collectors and investors. The NFT and digital asset space is evolving rapidly, and bitsCrunch ($BCUT) is positioning itself as a key player in this market. The future prospects of $BCUT are promising, with market trends indicating a growing demand for NFTs and digital assets.

The Bearish Trend: A Challenge or an Opportunity?

The bearish trend remains dominant in some cryptocurrencies, with prices trapped below major moving averages. For example, $ALPACA is showing a potential minor double bottom formation at $0.059, but this lacks confirmation without a break above $0.0633. This consolidation in a tight range presents a challenge for traders, who must navigate the market’s volatility and uncertainty. However, it also presents an opportunity for those who can identify the right entry and exit points.

The bearish trend in the cryptocurrency market presents both challenges and opportunities for traders. While the market’s volatility and uncertainty can be daunting, those who can identify the right entry and exit points may be able to capitalize on the market’s movements. It’s essential to stay informed and adaptable, ready to seize opportunities as they arise.

The Road Ahead

The cryptocurrency market in 2025 is a complex and dynamic landscape, filled with both challenges and opportunities. From potential reversals to significant investments, the market is constantly evolving. As we look to the future, it’s essential to stay informed and adaptable, ready to seize opportunities as they arise.

A Call to Action

For investors and enthusiasts alike, the key to success in the cryptocurrency market is to stay informed, stay adaptable, and stay vigilant. The market’s volatility presents both risks and rewards, and those who can navigate this landscape effectively will be well-positioned to capitalize on the opportunities that lie ahead. As we continue to monitor the market’s developments, let’s remember that the future of cryptocurrency is bright, and the possibilities are endless.

The cryptocurrency market in 2025 is a dynamic and ever-changing landscape, filled with both challenges and opportunities. From potential reversals to significant investments, the market is constantly evolving. As we look to the future, it’s essential to stay informed and adaptable, ready to seize opportunities as they arise. The key to success in the cryptocurrency market is to stay informed, stay adaptable, and stay vigilant. The market’s volatility presents both risks and rewards, and those who can navigate this landscape effectively will be well-positioned to capitalize on the opportunities that lie ahead.