“`html

Bitcoin Rollercoaster: Navigating Market Turbulence

Introduction

The cryptocurrency market, akin to a wild rollercoaster ride, especially Bitcoin, has been on a tumultuous journey of late. This analysis delves deep into the causes behind Bitcoin’s value plummeting and the pervasive market upheaval.

Current Market Turmoil

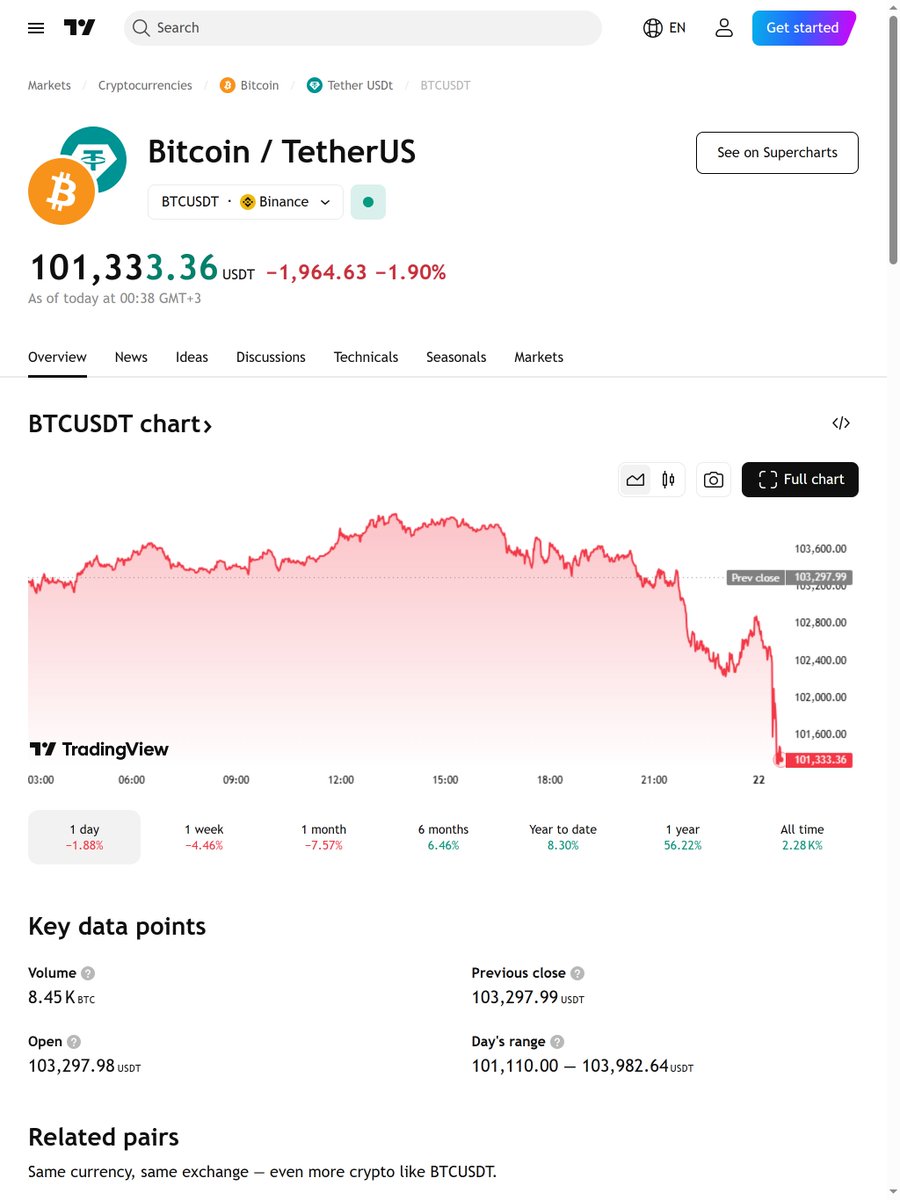

As of early March 2025, Bitcoin’s price resembled a rollercoaster, undergoing a significant dip after a sharp rise. Hovering around $92,000, it saw a surge of nearly 10% the day before [1]. Despite this uptick, investors tread lightly due to dwindling institutional demand, evident from the outflow from Bitcoin spot ETFs [1].

Factors Stirring Market Seas

- Institutional Demand Hitch

Bitcoin spot ETFs bore witness to a whopping outflow of $2.39 billion recently, signaling a sustained lack of interest from institutions [1]. This reluctance indicates that major investors are tip-toeing into the market, setting the stage for potential price swings.

- Regulatory Storm

The regulatory climate enveloping cryptocurrencies remains cloudy, dissuading potential investors. Despite this, glimmers of hope exist, such as the proposed U.S. Crypto Strategic Reserve, possibly boosting market faith if executed effectively [1].

- Technological Evolution and Embrace

While technological upgrades like those in the Bitcoin network are encouraging, they don’t immediately translate to increased usage or prices. A broader adoption by governments and businesses stands pivotal for enduring growth [2].

- Global Economic Influence

Macro-economic conditions, encompassing inflation and global tensions, can sway investor trust in cryptocurrencies. The heightened volatility in traditional markets, mirrored by the VIX, further fans the flames of uncertainty [1].

Ripple of Recent Proclamations

U.S. Crypto Strategic Reserve Proposition

President Trump’s discussion of a U.S. Crypto Strategic Reserve involving Bitcoin has piqued curiosity. In the past, such reserves have powered demand for commodities like gold, hinting at a similar outcome for cryptocurrencies entrenched in solid technological bases [1].

Gazing into the Future

- Forecast Felicity

Forecasts suggest Bitcoin could scale heights between $100,000 and $500,000 by end-2025, contingent upon macro-economic shifts and regulatory frameworks [2]. Nevertheless, these crystal ball projections teeter on speculation, susceptible to market twists.

- Regulatory and Technological Pinnacle

Transparency in regulations and technological strides, such as Ethereum’s transition to Proof of Stake, hold promise for market equilibrium and beckoning more investors [2].

Curtain Call

The current descent in Bitcoin’s worth echoes through the corridors of feeble institutional demand, regulatory opaqueness, and overarching economic currents. Despite glimmers of hope, like strategic reserves and technological leaps, the market’s rollercoaster ride persists. Vigilant monitoring of regulatory shifts and macro-economic currents remains imperative in traversing this unsure realm.

References

[1] Mitrade. (2025, March 3). Bitcoin Price Forecast: BTC corrects after sharp recovery during the weekend.

[2] Geek Metaverse. (2025, March 2). Bitcoin and Ethereum in March 2025: A comprehensive guide to the future of these leading cryptocurrencies.

“`

Related sources:

[1] www.mitrade.com

[4] moneymorning.com